tax strategies for high income earners 2021

The maximum federal tax rate for qualified dividends is 20. Its possible that you could.

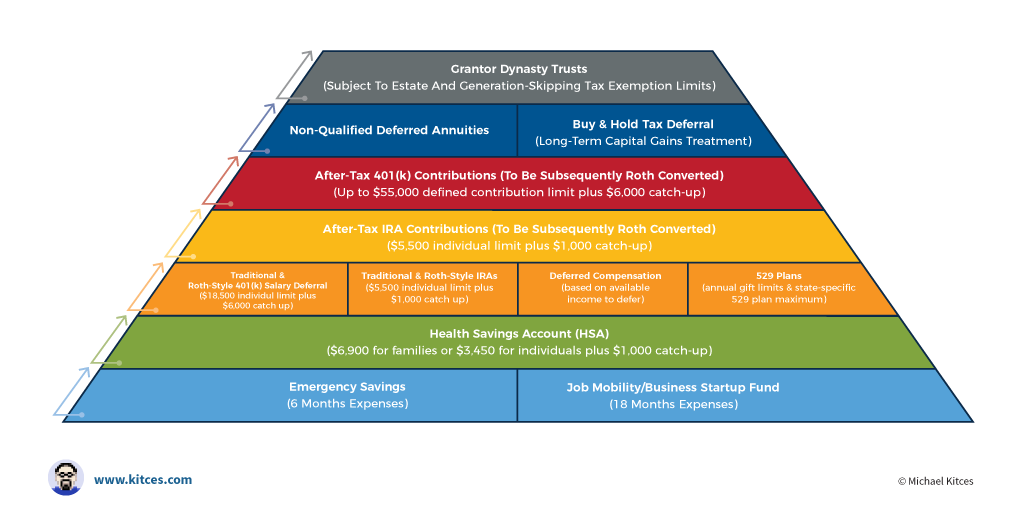

The Hierarchy Of Tax Preferenced Savings Vehicles

Using a donor-advised fund DAF is probably one of the best tax strategies for high income earners.

. The same donation amount will help the high. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities.

Another strategy you can use to provide for your slow-income spouse is by establishing a. Dont discount the wealth-generating potential and flexibility an HSA can afford. A Solo 401k for your business delivers major opportunities.

The maximum allowable contribution for 2021 was 19500 but for 2022 the cap has increased to 20500. Consider a 500 donation from a high earner in the 37 tax bracket and a similar donation amount from a taxpayer in the 10 bracket. And things are about to get worse if President Biden gets his way.

Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner. You can set up a solo 401 k plan that offers the same benefits if. Trial Tax Return.

Because it allows you to take current and future year contributions. For example the 2021 contribution limit for 401 k plans is 19500 meaning you can lower your taxable income by up to 19500 if you max out these deferrals. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners.

For 2021 the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. Its estimated that 90. If properly structured family trusts or partnerships can help you move your.

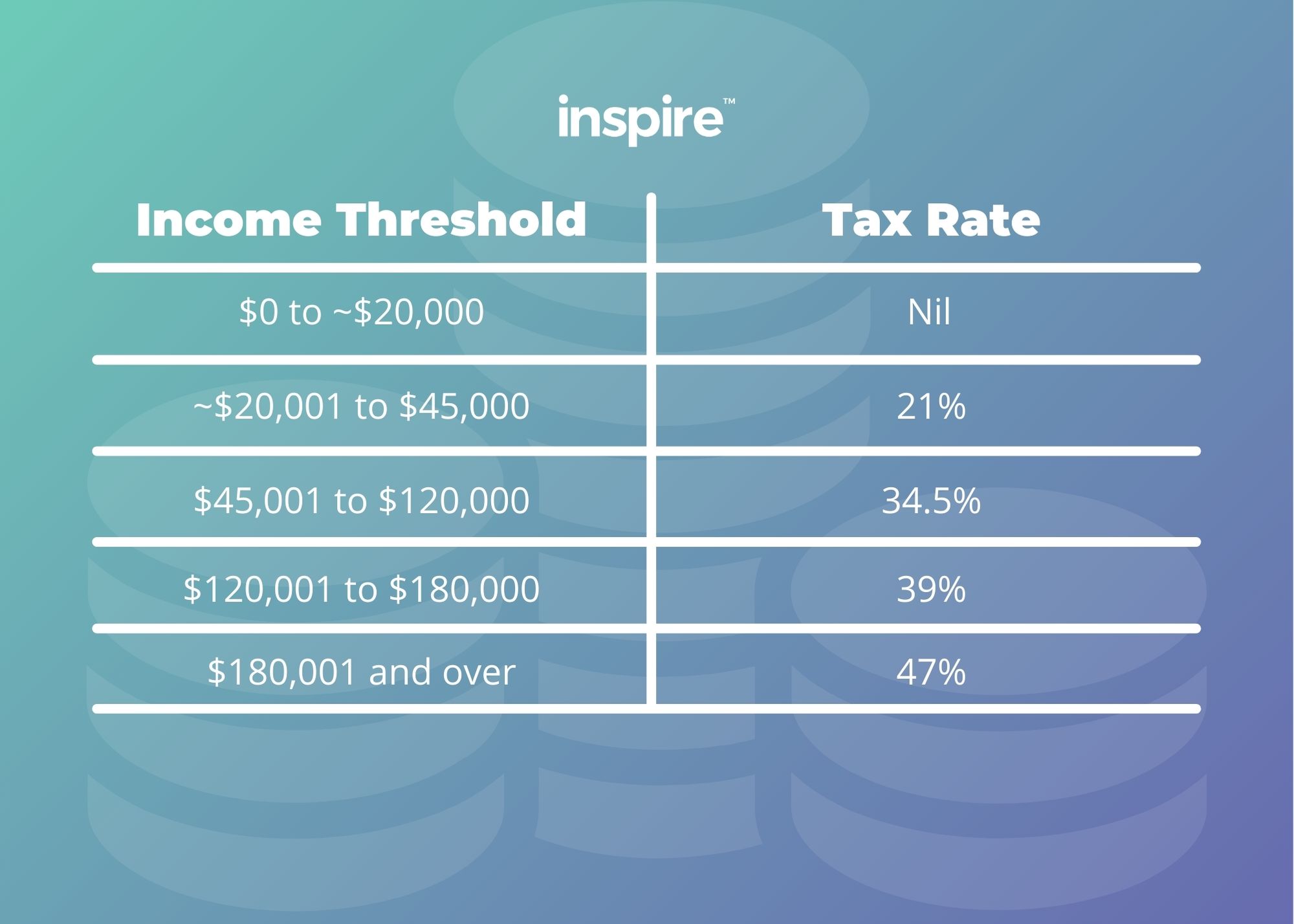

Trusts are among the most beneficial tax strategies for high income earners. The current top marginal tax rate in the US is 37. Tax Residency Planning One tax planning strategy to consider if you own properties in multiple states is tax.

One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Thats especially true if you earn more than 400000 as. Under RS rules you can deduct charitable cash contributions of up to 60 of.

As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

5 Outstanding Tax Strategies For High Income Earners

Tax Reduction Strategies For High Income Earners 2022

Tax Deductions For High Income Earners To Claim 2022

How To Minimize Taxes Like A Billionaire In 2021

High Income Earner Tips To Optimize Your 2020 Tax Return Davis Wealth Advisors

Higher Earners Will Pay More Social Security Tax In 2021 The Motley Fool

The 4 Tax Strategies For High Income Earners You Should Bookmark

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Five Tax Strategies For High Income Earners

Tax Strategies For High Income Earners To Help Reduce Taxes Youtube

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Reduction Strategies For High Income Earners 2022

Tabor Refund Low Earners Get More High Earners Get Less 9news Com

Tax Reduction Strategies For High Income Earners Youtube

5 Tax Strategies For High Income Earners Pillarwm

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Amazon Com Books

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane

Your 2022 Savings Strategies For High Income Earners Fuchs Financial